The

2016-17 Ontario Public Accounts came out yesterday – almost a month early. The Accounts finalize the books for 2016/17 and show that the deficit is down a further

$500 million from the last estimate for 2016-17 (which was made in the spring in the 2017 Budget).

The Shrinking Deficit: The deficit is now down below the billion dollar mark to $991 million. That is a full $3.3 billion less than the estimate

made in the 2016 Budget, continuing the long term trend by the Liberals to massively overestimate the deficit. Contrary to those who have claimed the deficit was insurmountable, the real story is that it has been consistently overestimated for years.

Revenue wobbles: Revenue did beat the 2016 Budget estimate for 2016/17 -- but only by $2.2 billion, 1.6% more than projected. The spring 2017 Budget estimated that revenue would beat the 2016 Budget projection by a larger figure -- $2.64 billion, 2% more than projected (albeit with a somewhat different accounting methodology). So this is a bit of a come down.

Total revenue increased by only 3.37% compared with 2015/16. The main drag on revenue growth was the largest component of revenue -- tax revenue. It increased by only 2.7%.

This is a surprisingly modest increase given that the economy did significantly better than expected over the fiscal year. Nominal growth (the key driver of tax revenue) was better than expected, achieving 4.6% in 2016. The first quarter of 2017 (i.e. the last quarter of the 2016/17 fiscal year) was particularly impressive. The province's first quarter 2017 economic accounts suggest nominal growth hit a very impressive 8% on an annualized basis (with real growth hitting an also impressive 4% annualized). The Canadian economy has continued to see strong growth in the second quarter of 2017.

Spending Less than Expected: Expenses were $100 million lower than budgeted due to a $700 million lower

than expected interest expense and $600 million in extra program expense.

That is extra program spending of less than half a percent, i.e. not much. Given all the mid-year funding announcements made by the government starting in the fall of 2016, that may surprise some. But, as this government often under-spends its planned budgets, this very modest program spending increase is pretty consistent with past practice.

That is extra program spending of less than half a percent, i.e. not much. Given all the mid-year funding announcements made by the government starting in the fall of 2016, that may surprise some. But, as this government often under-spends its planned budgets, this very modest program spending increase is pretty consistent with past practice.

The health care budget got a $236 million in-year increase –

mostly for hospitals (which we can take some credit for).

Total program

expenditures increased only 1.5% over 2015/16; health care expenditures increased 1.9%. That is well below the real cost pressures on public services of aging, population growth and inflation. Austerity was alive and well in 2016/17.

The war with the AG continues: The Auditor General offered only a qualified opinion on the Public Accounts – due in

part to the longstanding differences she has with the government over pension

accounting (a difference that would add much to the deficit and debt).

The FAO misses, again: The Public Accounts provide further evidence that the Financial Accountability Office (FAO) estimates of the deficits are out of whack.

Only a few months ago the FAO estimated (using the government’s pension accounting method, not the Auditor's) the 2016-17

deficit as at $2.8 billion – i.e. 280% of the actual deficit.

That is pretty much in line with the FAO's earlier gross overestimates. I expect more along these line from them when they release their long term fiscal forecast later this month -- hopefully they will at least adjust their base year estimate for 2016/17 now.

That is pretty much in line with the FAO's earlier gross overestimates. I expect more along these line from them when they release their long term fiscal forecast later this month -- hopefully they will at least adjust their base year estimate for 2016/17 now.

If you can't hammer public spending with the deficit, then what? The government continues to forecast balanced budgets for

this year and the following two.

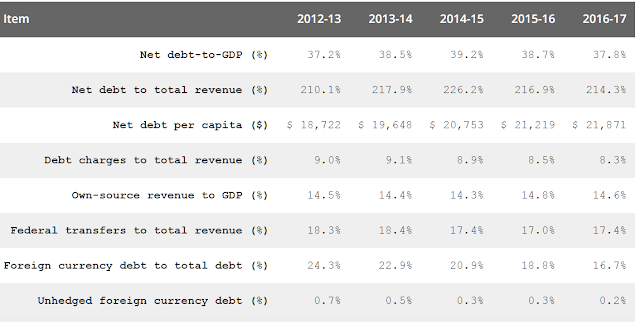

The Progressive Conservatives wisely continue to pivot away from their previous excitement over the deficit -- but continue to pivot towards complaints about the debt, despite the continued significant decline in debt to GDP that was achieved in 2016/17. Debt in 2016/17 was 1.4% less of the GDP than two years earlier.

Debt charges to total revenue also continues to decline -- for the third year in a row:

Comments

Post a Comment